vanguard short term tax exempt bond etf

Actual after-tax returns depend on your tax situation and are not relevant if you hold shares through tax-deferred arrangements such as IRAs or 401 k plans. Find the latest Vanguard Short Term Tax Exempt Fund VWSTX stock quote history news and other vital information to help you with your stock trading and investing.

Vanguard S New Venture Indexing Muni Bonds Morningstar

VWLTX A complete Vanguard Long-Term Tax-Exempt FundInvestor mutual fund overview by MarketWatch.

. Next up the Vanguard Tax-Exempt Bond ETF was developed to track an underlying benchmark that tracks investment-grade municipal bonds in the United States. Vanguard Limited Term Tax Exempt Fund - The investment seeks current income that is exempt from federal personal income taxes with limited price volatility. Invests primarily in high.

The fund has no limitations on. Vanguardfi Short-Term Tax-Exempt Fund As of September 30 2022 ProductSummary Short-term municipal bonds. View mutual fund news mutual fund market and mutual fund interest rates.

A single bonds maturity date represents the date that the company municipality or government that sold the bond the issuer agrees to return the principleor. 29 rows The big iShares ETF and its sister fund Short-Term National Muni SUB are the cost winners now. For the quarter Vanguard Short-Term Tax-Exempt Fund underperformed in benchmark the Bloomberg 1 Year Municipal Bond Index 038 but outperformed its peer-group average.

The fund is designed for investors with alow tolerance for. Seeks current income exempt from federal tax. This tax update provides information to help you report earnings by state from any of your Vanguard municipal bond funds and Vanguard Tax-Managed Balanced Fund on your year-end.

VTEB Vanguard Tax-Exempt Bond ETF Check VTEB price review total assets see historical growth and review the analyst rating from Morningstar. Vanguard Short-Term Tax-Exempt Bond is managed by diligent leaders through a sensible and risk-conscious investment process and benefits from ultra-low fees. Although the income from municipal bonds held by a fund is exempt from federal tax you may owe taxes on any capital gains realized through the funds trading or through your own.

MUB and SUB are on our Honor Roll.

Vanguard Limited Term Tax Exempt Bond Fund Tax Distributions Bogleheads

Investors Keep Turning To Active Fixed Income Etfs Etf Trends

Vwitx Vanguard Intermediate Term Tax Exempt Fund Investor Shares Portfolio Holdings Aum 13f 13g

The Best Bond Etfs A Complete Guide Ycharts

Best Municipal Bond Funds Best Mutual Funds Awards 2022 Investor S Business Daily

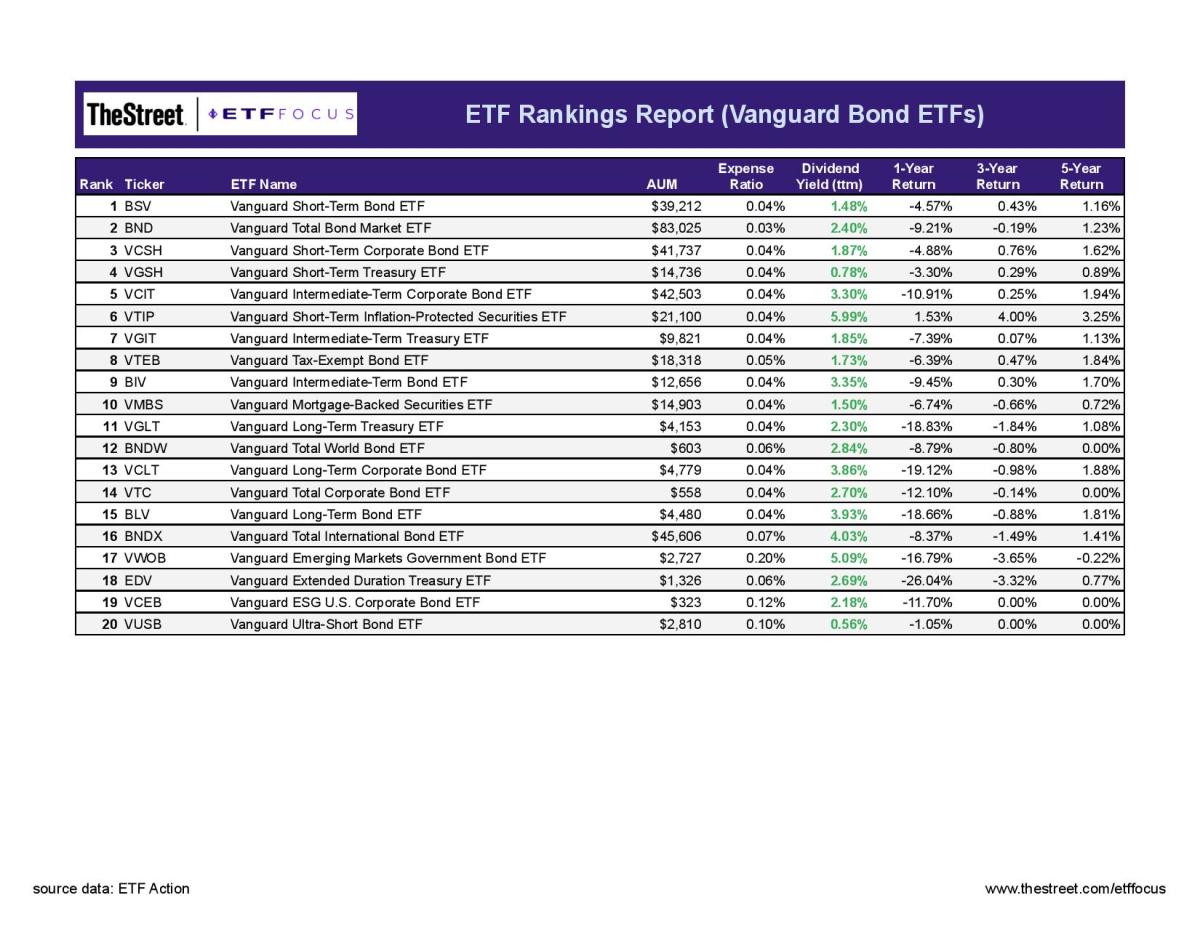

Best Vanguard Bond Etfs Updated August 2022 Etf Focus On Thestreet Etf Research And Trade Ideas

Short Term Cash Investing With Money Market Funds Vanguard

2019 Etf Returns Were Very Strong For Both Equity And Fixed Income

How To Pick A Muni Bond Etf Etf Com

Best Vanguard Bond Etfs Updated August 2022 Etf Focus On Thestreet Etf Research And Trade Ideas

The Best Performing Bond Etfs How To Find Them Nasdaq

What The Inflows For Vanguard S Bond Etfs Indicate

Should I Invest In New Jersey Municipal Bonds Sapient Investments

Schwab S Debut Muni Etf Beats Vanguard On Costs

Vanguard Tax Exempt Etf Nysearca Vteb For Investors Wanting Quality Without Leverage Seeking Alpha

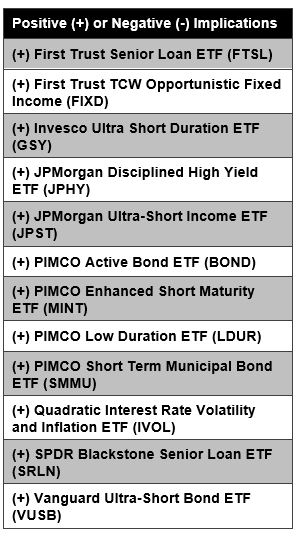

Cashing In As Interest Rates Top 4 Etf Com